Courtesy of ExxonMobil

Courtesy of ExxonMobilEtter kvart som dei vitskaplege prova for ein komande topp i oljeutvinninga tårnar seg opp, er det ikkje meir enn rimeleg at "mainstream-media" også startar ei viss dekking av saka.

No har avisa The New York Times i ein leiarartikkel uttalt at peak oil "is almost certainly correct":

When President Bush declared in his 2006 State of the Union address that America must cure its "addiction to oil," he framed his case largely in terms of national security -- the need to liberate the country from of its dependence on volatile and in some cases hostile nations for much of its energy. He failed to mention two other good reasons to sober up. Both are at least as pressing as national security. One is global warming...

The second reason is just as unsettling, and is only starting to get the attention it deserves. The Age of Oil -- 100-plus years of astonishing economic growth made possible by cheap, abundant oil -- could be ending without our really being aware of it. Oil is a finite commodity. At some point even the vast reservoirs of Saudi Arabia will run dry. But before that happens there will come a day when oil production "peaks," when demand overtakes supply (and never looks back), resulting in large and possibly catastrophic price increases that could make today's $60-a-barrel oil look like chump change. Unless, of course, we begin to develop substitutes for oil. Or begin to live more abstemiously. Or both. The concept of peak oil has not been widely written about. But people are talking about it now. It deserves a careful look -- largely because it is almost certainly correct.

(Heile artikkelen er bak betalingsmuren..)

Mange folk vurderer opplysningar ikkje berre utifrå innhald, men (minst) like mykje utifrå kven som kjem med opplysningane. "Mainstream-media" er då det som vert kalla "autoritativt hald". Kanskje det at NYT no tek peak oil innover seg, kan føre til noko auka merksemd? Kanskje så mykje at dei styrande elitar (som heilt sikkert veit kva som skjer) vil måtte ta opp problemet offentleg?

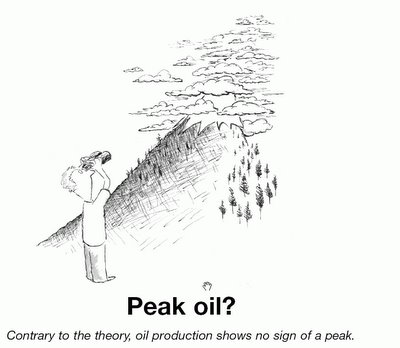

I det same nummeret av NYT har Exxon (verdas største oljeselskap) ei annonse som slår fast at peak oil ikkje er i syne. (Teikninga på toppen teken frå denne..) Mot betre vitande? Her finn du ASPO-USA sin kommentar.

Stuart Staniford på The Oil Drum har ein post der han forklarar kvifor han trur "oljetoppen" er omtrent no. For dei som ikkje vil eller kan gå til kjelda, kjem det i kortversjon her:

- Det er mykje truleg at reservane som er rapportert av OPEC er overdrivne

- Oljeutvinninga i verda slutta å auke på slutten av 2004

- "Decline rates" (fall i produksjon) i eksisterande felt er høge

- Hubbert lineærisering peikar mot peak oil

- Minst eitt oljeselskap (Chevron) åtvarar oss

- Oljeprisen stig

- Der er ikkje prov på reservekapasitet i Saudi-Arabia

- Der er geopolitske og klimatiske trugsmål mot noverande utvinningstakt

Tidspuktet for peak oil kan berre slåast fast i ettertid, men eg er samd med Ken Deffeyes som uttalar: "Mi rolle som profet er over, eg er no historikar."

3 kommentarer:

Det var nettutgaven av NYT som brakte kommentaren. Papirutgaven har ikke dristet seg til denslags enda.

Vi får håpe at norske media etterhvert drister seg til å skrive mer. Morgenbladet hadde en reportasje 3. mars i år.

Noen tar kampanjen til ExxonMobil til SEC

--------------------------

I have today filed a formal complaint with the SEC about Exxon Mobil's

advertisement in the New York Times on March 2, 2006. The complaint

specified Lee Raymond, CEO, Exxon Mobil. The original advertisement

may be seen at Exxon's web site at

http://exxonmobil.com/Corporate/Files/Corporate/OpEd_peakoil.pdf

/Start of details of complaint

Lee Raymond, CEO of Exxon Mobile, either knew or should have known about a very high profile advertisement placed by Exxon Mobile in the New York Times on March 2, 2006, page A29. The advertisement violates securities regulations in at least one way cited below.

The advertisement seeks to refute the imminence of an all-time peak and subsequent decline of oil production. It says, among other things,

1) "oil production shows no sign of a peak"

2) "a peak will not occur this year, next year or for decades to come"

3) "peak production is nowhere in sight"

An obvious inference from this prominent advertisement is that Exxon Mobil has reasons consistent with SEC rules on claims for future performance to believe that Exxon Mobil's oil production will not peak for "decades to come". In other words, Exxon Mobil's advertisement, by obvious inference, claims that Exxon Mobil's oil production will increase generally for "decades to come".

I have searched Exxon Mobil's recent quarterly and annual reports for information or claims in support of such a claim, and have not found it. Without immediate prominent public clarification or citation of existing documentation for this claim by Exxon Mobil, this advertisement must be considered to be in violation of Rule 10b-5(b): "To make any untrue statement of a material fact or to omit to state a material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading"

/End of details of complaint

Great read! It reminded me of my recent blog on best jungle safari in india, where I covered some related ideas. I think your readers would appreciate the additional insights I shared. Thanks for providing such useful content!

Legg inn en kommentar